Bookkeeping For Startups: Our Firm Supplies Virtual Financial Record-Keeping For Companies

Functions and Benefits: Opening Your Company's Monetary Prospective

Ever feel like you're drowning in a sea of receipts and spreadsheets? The contemporary organization landscape, teeming with development and rapid modification, demands a various technique to monetary management. This isn't practically keeping the books; it has to do with tactical insights, performance, and eventually, peace of mind. Online bookkeeping services aren't merely a trend; they're an essential shift, using a suite of features designed to empower your business.

Secret Functions of Online Bookkeeping

Think of it like updating from a horse-drawn carriage to a high-performance sports cars and truck. What capabilities does this upgrade bring?

- Automated Transaction Classification: No more manual sorting! Your bank and charge card transactions are automatically drawn in and designated to the right categories. It resembles having a meticulous curator for your financial resources.

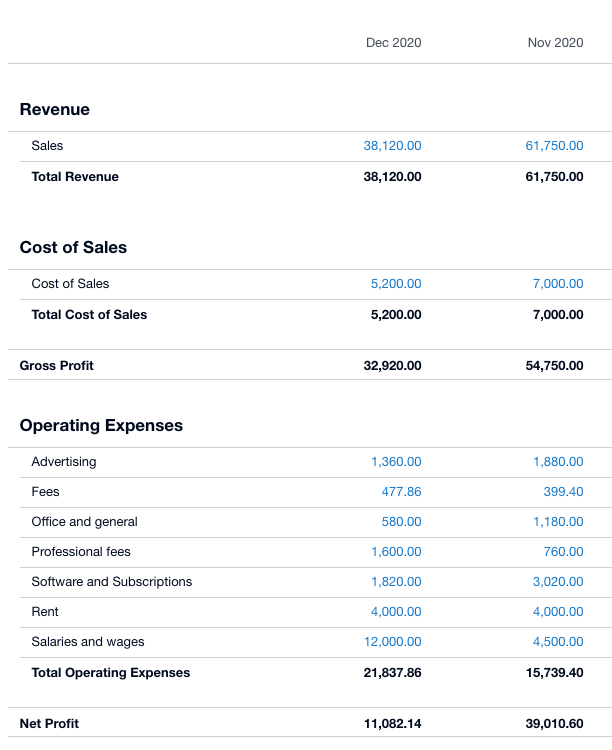

- Real-time Financial Reporting: Envision understanding your specific monetary standing at any given minute. Online platforms offer up-to-the-minute reports, from profit and loss statements to balance sheets. This isn't the other day's news; it's now.

- Expenditure Tracking and Management: Gone are the days of shoeboxes loaded with crumpled invoices. Digital expenditure capture, typically through mobile apps, ensures every cent spent is represented, simplifying tax preparation and budget plan adherence.

- Billing Management and Expense Pay: Streamline your balance dues and payable. Develop professional billings, send automated reminders, and even schedule costs payments. Capital management ends up being a breeze.

- Bank Reconciliation: A crucial action for accuracy, online services automate this process, capturing discrepancies immediately. It's the financial equivalent of a double-check system, guaranteeing everything lines up completely.

- Secure Data Storage: Your financial data is a bonanza. Online services employ robust file encryption and security protocols, securing your delicate info from unapproved access.

The Tangible Advantages: Why It Matters to You

Beyond the bells and whistles, what real-world benefits do these functions equate into for your organization? The advantages are extensive, impacting everything from functional efficiency to strategic decision-making.

- Time Savings: This is maybe the most immediate and impactful advantage. How much time do you presently invest battling with monetary records? Online bookkeeping liberates hours, permitting you to focus on core organization activities, development, and development.

- Improved Accuracy: Automation considerably decreases the margin for human error. Fewer mistakes mean more reliable financial data, which is essential for sound decision-making.

- Enhanced Capital Management: With real-time insights into income and costs, you can expect financial ups and downs, making informed decisions about financial investments, payroll, and operational costs.

- Expense Effectiveness: While there's a financial investment, the long-lasting savings from lower errors, structured processes, and potentially lower accounting charges often surpass the initial expense. It's about clever spending, not just cutting corners.

- Scalability: As your organization grows, your accounting requires evolve. Online platforms are naturally scalable, adapting to increased deal volumes and more complicated monetary structures without needing a total overhaul.

- Much better Decision-Making: Equipped with accurate, current financial reports, you acquire a clearer photo of your organization's health. This empowers you to recognize patterns, pinpoint areas for improvement, and make tactical options with confidence. It's like having a GPS for your organization journey.

The shift to online bookkeeping isn't simply a functional upgrade; it's a strategic move towards a more efficient, insightful, and ultimately, more successful future for your company. Are you prepared to embrace the clearness and control it uses?

Secret Factors To Consider for Selection

Choosing the ideal online accounting service isn't practically choosing the very first name that pops up in a search; it's a complex dance of evaluating needs versus offerings. Have you genuinely considered the large volume of deals your business produces regular monthly? A little consulting company with a handful of invoices varies greatly from an e-commerce giant processing hundreds of everyday sales. Many little organization owners, in their passion to offload financial jobs, frequently underestimate the sheer scale of their own operations, leading to mismatched service tiers and unforeseen friction down the line. It's like attempting to fit a square peg in a round hole-- annoying for everybody included.

Scalability and Future Growth

The service you pick today should comfortably accommodate your goals for tomorrow. Will your picked online accounting service flawlessly scale as your company expands? Envision the turmoil of switching companies mid-year since your existing plan can't manage an abrupt rise in revenue or the addition of new product lines. This oversight, though apparently minor at the outset, can speed up considerable operational disruption and information migration headaches. Search for providers that provide tiered service levels or customizable bundles, permitting graceful shifts as your requirements progress. A genuinely skilled tip: ask about their process for onboarding new staff members or integrating extra payment entrances. These seemingly small details typically expose the true versatility of their system.

Integration Abilities

Does the prospective service play well with your existing tech stack? This isn't merely a convenience; it's an important operational artery. Picture this: your e-commerce platform, CRM, and payroll system all humming along, but your new bookkeeping service stands aloof, demanding manual information entry. This produces a bottleneck that can negate any time savings you hoped to attain. Look for services boasting robust combinations with popular company tools. Do they link straight with copyright Online, Xero, or even industry-specific software application you might use? A lack of seamless combination often causes redundant data entry, a breeding ground for mistakes, and a considerable drain on valuable time. It's the digital equivalent of handwriting every transaction, only to re-type it into another system. Think about the following combination points:

- Payment Processors (Stripe, PayPal, Square)

- Payroll Solutions (Gusto, ADP)

- CRM Systems (Salesforce, HubSpot)

- E-commerce Platforms (Shopify, WooCommerce)

Data Security and Confidentiality

In an age where information breaches make headlines with alarming regularity, the security posture of your picked accounting options service provider can not be overstated. Are your monetary secrets truly safe? Delve beyond generic assurances. Ask about their encryption protocols, data backup treatments, and catastrophe recovery plans. Do they use multi-factor authentication? Are their servers frequently audited for vulnerabilities? A less apparent but essential element is their employee vetting process; who has access to your delicate financial information? Keep in mind, a chain is only as strong as its weakest link. A credible virtual accounting company will be transparent about their security measures, not just provide unclear pledges. It's your monetary heart beat we're talking about; do not delegate it to just anybody.

Seamless Software Application Symphony: Integrating Your Financial Community

.jpeg?width=869&height=581&name=AdobeStock_124308052%20(1).jpeg)

Ever seemed like your financial information is spread across a lots different islands, each requiring a separate boat ride? It's a typical dilemma, especially for organizations welcoming the digital age. The genuine magic of online bookkeeping services really shines when they don't just exist in isolation but instead end up being get more info the main nerve system for your whole operational software application suite. Think of it: your CRM holds consumer data, your stock system tracks stock, and your payroll software handles employee compensation. Without proper integration, you're left manually inputting data from one system to another, a tedious and error-prone dance that saps valuable time. This isn't merely troublesome; it produces a fertile ground for discrepancies, resulting in a distorted view of your financial health. Keep in mind the old expression, "Trash in, trash out"? It holds particularly real when financial figures are included. A single misplaced decimal can ripple through an entire quarter's reporting.

Navigating the Combination Maze

How do you guarantee your monetary management software application plays well with the rest of your digital toolkit? It's less about finding a mythical "one-size-fits-all" service and more about strategic choice and thoughtful implementation. Many top-tier online bookkeeping platforms boast a robust API (Application Programming User Interface), which is basically a digital handshake allowing various software application to interact and exchange data instantly. When assessing prospective services, constantly ask about their existing integrations. Do they get in touch with the accounting software you currently use? What about your e-commerce platform or expense management tools? The depth and breadth of these pre-built connections can save you tremendous development time and resources. Sometimes, a customized combination might be needed, but this ought to be a last resort, as it typically includes higher costs and more complex maintenance.

- Prioritize platforms with a strong track record of third-party combinations.

- Try to find open APIs that allow for future custom-made connections if needed.

- Think about the bi-directional circulation of information-- does information move both ways perfectly?

Unlocking Efficiencies and Insights

The real power of integrated accounting services depends on the removal of redundant data entry and the creation of a combined information source. Think of a world where a sale tape-recorded in your CRM instantly updates your stock and triggers an invoice in your accounting system. This isn't futuristic dream; it's the present truth for organizations that strategically integrate their software application. This smooth circulation of information not only enhances operational performance but also offers an unequaled holistic view of your organization efficiency. You can create real-time reports that cross-reference sales data with stock levels, or payroll expenses with project profitability. This integrated information allows more educated decision-making, enabling you to identify patterns, pinpoint areas of ineffectiveness, and seize opportunities with higher precision. It resembles having a crystal ball, however rather of unclear predictions, it offers actionable insights originated from your own interconnected information. Do not underestimate the extensive impact this can have on your tactical preparation and bottom line.

Security and Data Privacy: A Digital Fortress for Your Finances

Ever felt that small trembling of anxiety when thinking about the digital realm for your most sensitive monetary information? It's a valid concern, one that echoes the tale of Pandora's Box, however with a contemporary twist. Online bookkeeping services assure unparalleled benefit, yet the specter of a data breach looms big for many. Is it a handle the digital devil, or a sensible enter the future? The reality, as always, lies in the information-- specifically, the robust security procedures put in location by trusted service providers. Think of it less as a leap of faith and more as entrusting your prized possessions to a high-security vault, albeit one accessible from your couch.

The primary issue for businesses, especially little and medium-sized enterprises, frequently focuses on the vulnerability of their financial records. Imagine the mayhem if proprietary information, customer lists, or even staff member payroll details fell into the wrong hands. This isn't simply a trouble; it's a potential disaster that could maim operations and wear down trust. Many organization owners, accustomed to physical journals and locked filing cabinets, come to grips with the abstract nature of digital safeguards. They ask, "How can I make sure my numbers aren't just drifting out there for anyone to nab?" The answer depends on comprehending the layers of defense utilized. Information file encryption, for example, isn't simply a technical term; it's the digital equivalent of scrambling your details into an unreadable code, making it indecipherable to unapproved eyes. Even if intercepted, without the decryption key, it's simply mumbo jumbo.

Strengthening Your Digital Ledger

Beyond file encryption, what other bulwarks should you anticipate from a top-tier online accounting option? Multi-factor authentication (MFA) is non-negotiable. It's the digital bouncer who demands not just your password, however a second form of confirmation-- perhaps a code sent out to your phone or a biometric scan. This substantially lowers the risk of unauthorized access, even if a password is compromised. Think about the situation where a staff member mistakenly clicks a phishing link; with MFA, the breach is likely avoided before any real damage takes place. Look for service providers who undergo regular, independent security audits. These aren't simply internal checks; they're external professionals attempting to break in, recognizing and shoring up any weak points. Believe of it as a professional ethical hacker offering the system a thorough stress test. What about the physical location of the information? Reliable services house their servers in highly secure, geographically distributed data centers, frequently with redundant power materials and advanced fire suppression systems. This safeguards versus localized catastrophes, ensuring your data remains accessible and intact, come what might. The strength of these systems typically surpasses what any specific company might realistically implement by itself.

When examining service providers, delve much deeper than surface-level guarantees. Inquire about their information backup and healing protocols. How regularly is data backed up? Where are these backups saved? In the not likely event of a system failure, how quickly can your data be restored? A robust catastrophe recovery strategy is the digital equivalent of an escape route, making sure connection even in unforeseen circumstances. Look for services that provide granular access controls, enabling you to determine specifically who can see or modify specific monetary details. This internal control is simply as crucial as external security, avoiding unexpected mistakes or harmful actions from within your own group. Keep in mind, real digital comfort originates from a detailed approach to security, not simply a couple of isolated functions. It's about constructing a digital fortress, brick by encrypted brick.